Ok so I grew up in Brazil.

I watched my family's savings just melt. Not because anyone made bad decisions, but our National currency, BRL (REAL) kept losing value against the dollar, year after year. Inflation wasn't something I read about it. It was why everything cost more every single month.

So when people on crypto Twitter debate whether Bitcoin is "digital gold" or a "speculative asset", honestly?

You're asking the wrong question.

The Western Lens Problem

Here's the thing, most crypto influencers talk about Bitcoin from a place of privilege.

They live in countries with stable currencies, USD, EUR, AUD. For them, Bitcoin is a portfolio allocation. Something you put 5-10% of your net worth into and check on weekends.

But for billions of people in emerging markets — Brazil, Argentina, Turkey, Nigeria, Lebanon — Bitcoin solves a completely different problem. It's not about getting rich. It's about not getting poor.

And that distinction matters SO much more than people realize.

Currency Debasement Is Real

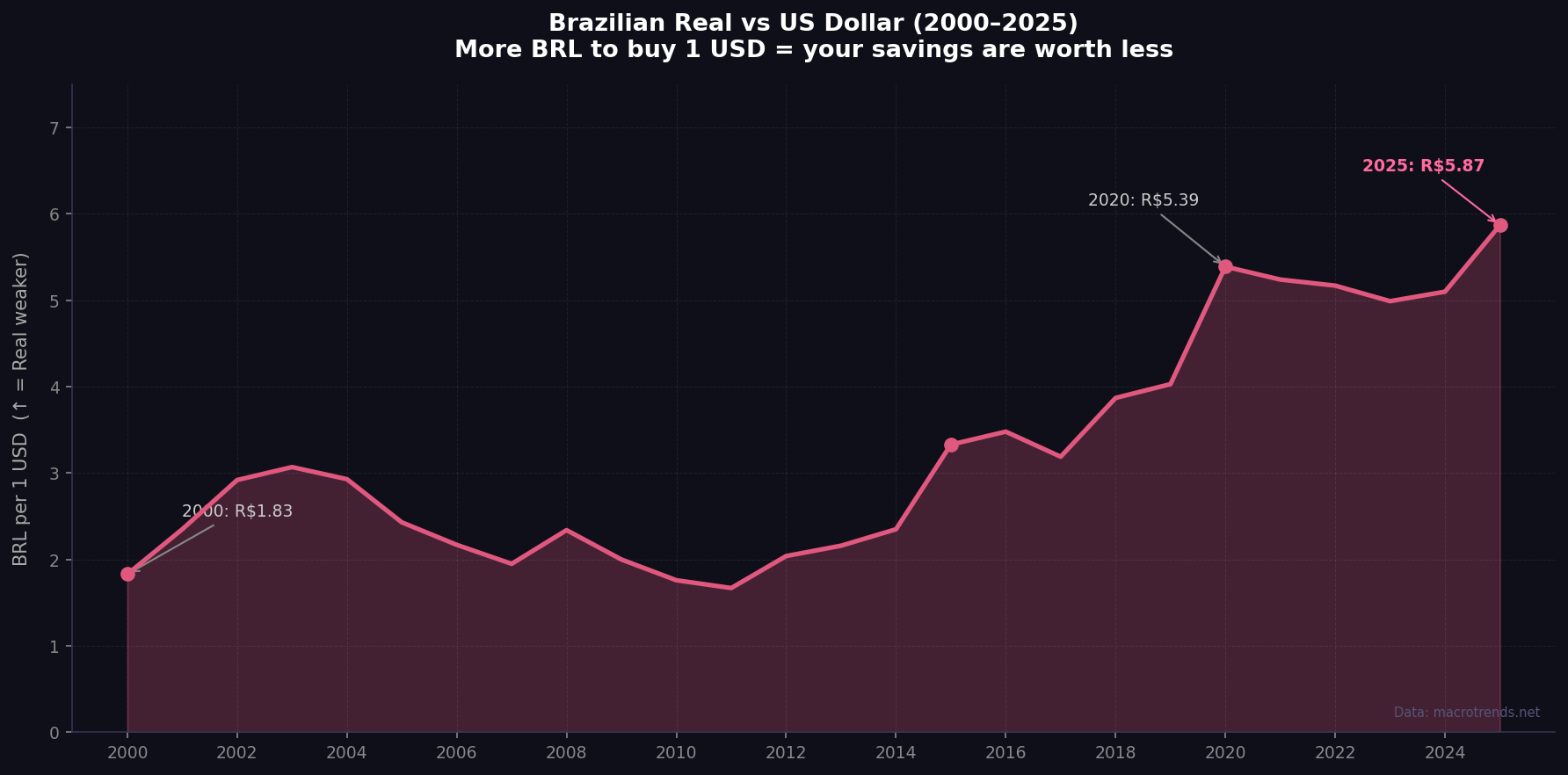

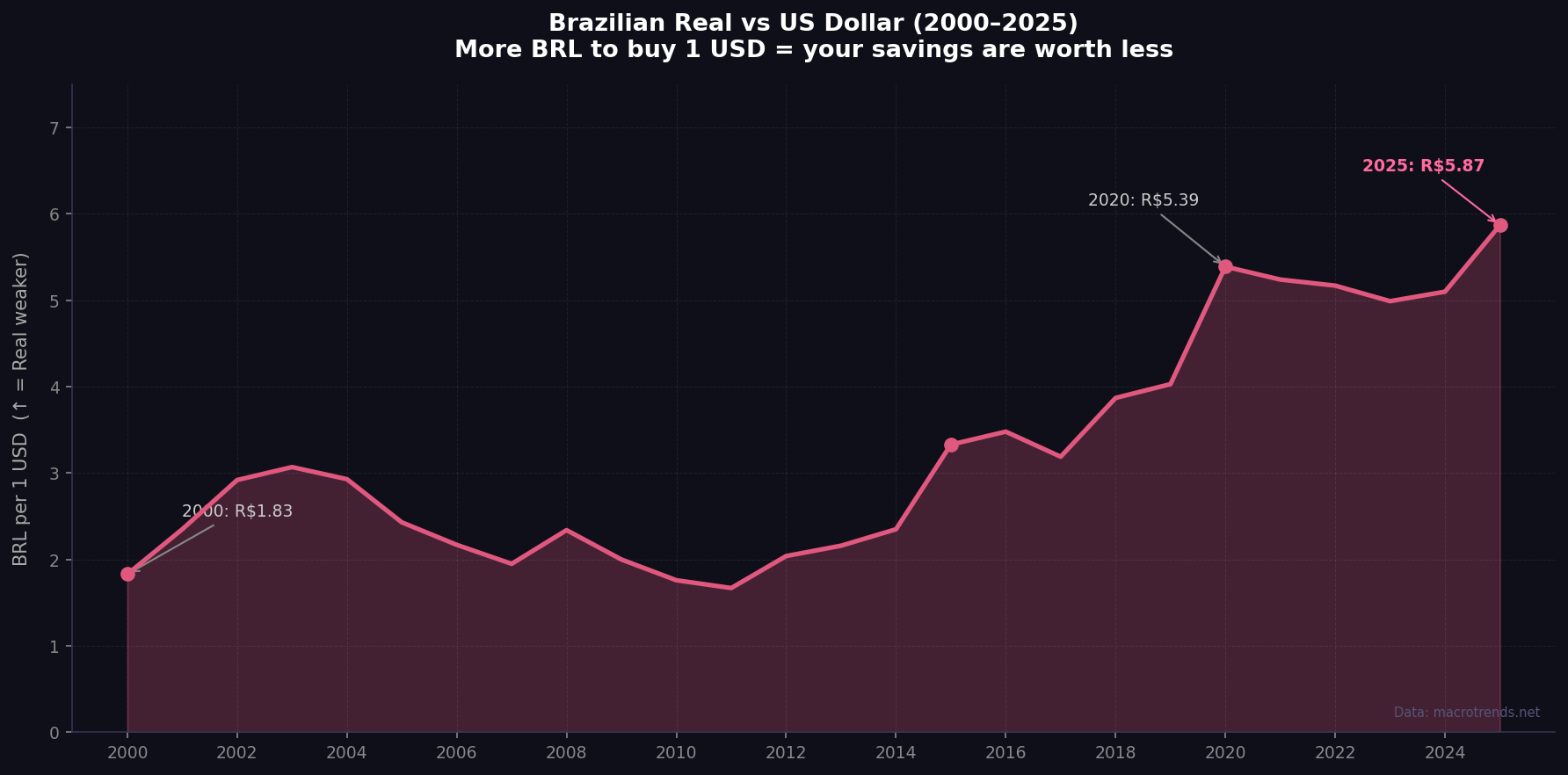

Source: macrotrends.net — USD/BRL historical exchange rate 2000–2025.

The Brazilian Real has lost roughly 80% of its value against the USD over the past two decades. The Argentine Peso? Don't even get me started lol. The Turkish Lira lost 90% of its value in the last 5 years alone. 90%! 🤯

When your local currency is actively melting, Bitcoin's volatility looks different. Yeah, BTC can drop 30% in a month. But it doesn't go down 95% over a decade while your government prints more money. That's the key.

In emerging markets, Bitcoin isn't competing with the S&P 500. It's competing with a savings account that loses value every single day.

Real Adoption Looks Different

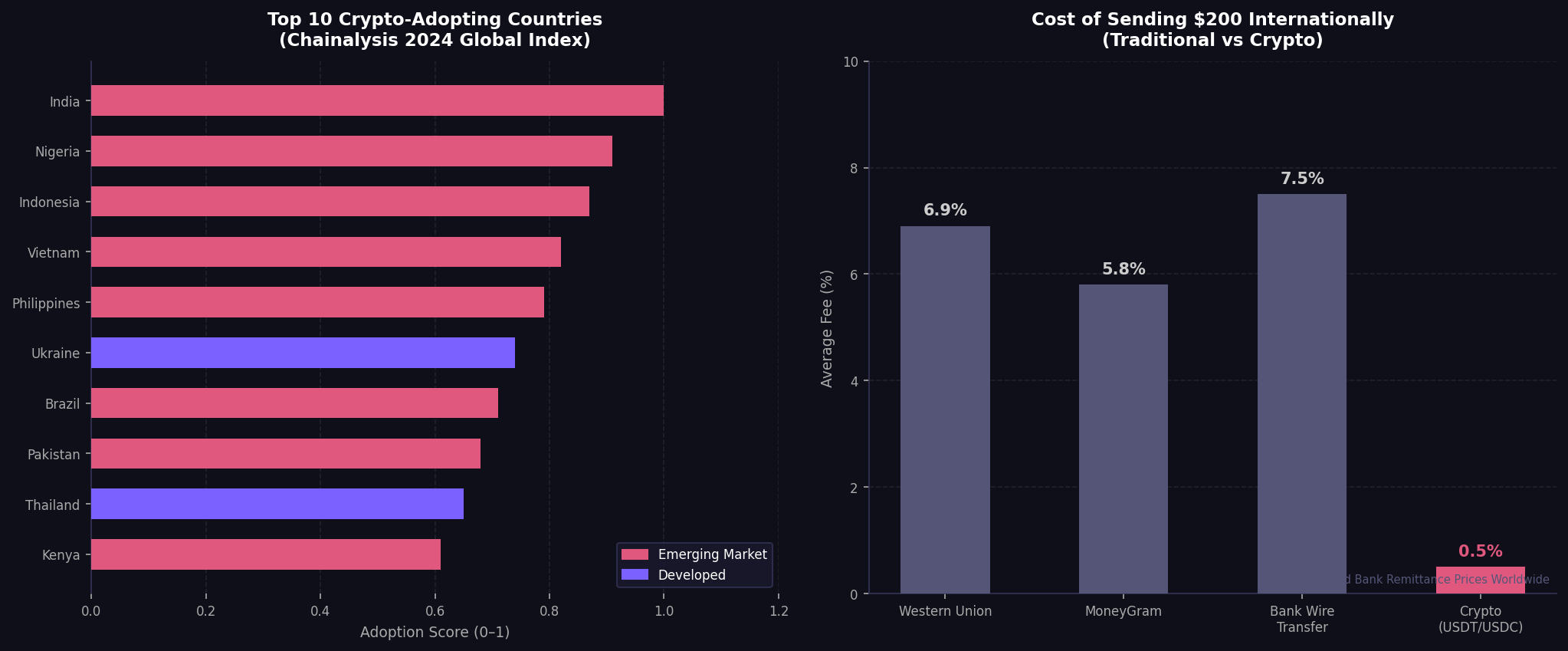

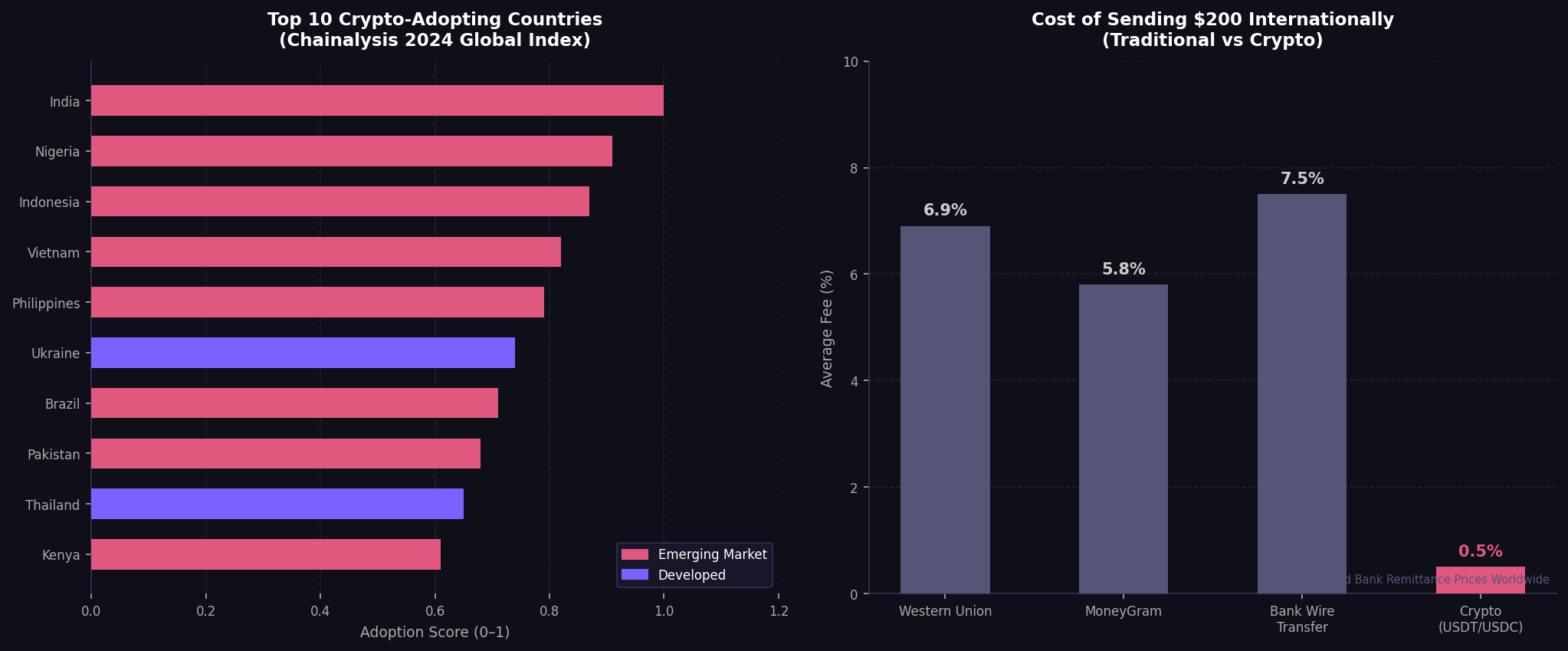

Left: Chainalysis 2024 Global Crypto Adoption Index. Right: World Bank Remittance Prices Worldwide.

When Western media talks about "crypto adoption," they mean institutional investors buying Bitcoin ETFs. Cool. But real adoption, the kind that actually changes lives, looks like this:

A freelancer in Nigeria getting paid in USDT because their bank account gets frozen for receiving foreign currency

A family in Venezuela storing savings in Bitcoin because the Bolívar is literally worthless

A small business owner in Brazil using stablecoins to avoid 5% forex fees on international payments

A worker in the Philippines sending money home through crypto instead of paying 10% to Western Union

This isn't speculation, this is humans surviving and I see daily now.

The Store of Value Narrative Works — For the Right People

Look, I've always believed Bitcoin's strongest use case is as a store of value for people who don't have access to better alternatives. And that's not some niche market, it's the majority of the world's population.

If you're reading this from the US or Europe, Bitcoin might feel redundant. You have index funds, government bonds, FDIC-insured bank accounts. Good for you, genuinely.

But if you're reading this from São Paulo, Buenos Aires, Istanbul, or Lagos, you know exactly what I'm talking about.

What This Means for the Industry

The crypto industry needs to stop building exclusively for Silicon Valley and start building for São Paulo, Lagos, and Jakarta. The biggest opportunity isn't the next DeFi protocol for whales, it's making financial tools accessible to the 4 billion people who are underserved by traditional finance.

That's what I try to do with my content. Make crypto accessible. Break down the barriers. Because for people like me, from places like where I grew up, his technology isn't a luxury. It's a necessity

References

Chainalysis 2024 Global Crypto Adoption Index

World Bank Remittance Prices Worldwide

Nigerians Using P2P Crypto to Circumvent Dollar Scarcity — CoinDesk

Venezuelans Turn to Crypto to Fight Inflation — Reuters

In the Philippines, Crypto Is Replacing Western Union — CoinDesk